For real estate investors, securing financing can feel like a never-ending obstacle course. Traditional lenders demand W-2s, tax returns, and debt-to-income (DTI) calculations—requirements that don’t always align with the way investors manage their finances.

That’s where no-income verification loans with EDSCR (Economic Debt Service Coverage Ratio) come in. These loans don’t require proof of personal income, making them a game-changer for self-employed investors, landlords, and entrepreneurs.

But here’s the catch: Lenders don’t always tell you everything upfront.

In this article, we’re revealing the insider secrets lenders don’t share about EDSCR-based no-income verification loans, so you can navigate the process like a pro and avoid costly mistakes.

What Are No-Income Verification Loans with EDSCR?

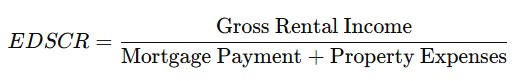

Unlike traditional mortgages, which base approval on your personal income and employment history, EDSCR-based loans qualify borrowers based on the rental income of the investment property itself.

Here’s how it works:

✔ No W-2s, tax returns, or income statements required

✔ Approval is based on the property’s ability to generate rental income

✔ Ideal for real estate investors, house flippers, and self-employed individuals

Lenders focus on one key metric: The EDSCR Ratio.

- 1.0+ EDSCR Ratio → The property breaks even (covers its debt).

- 1.25+ EDSCR Ratio → The property generates positive cash flow (preferred by lenders).

- Below 1.0 EDSCR Ratio → The property isn’t generating enough income to cover its expenses (high-risk for lenders).

In theory, it sounds like an easy approval process. But lenders have hidden requirements and fine print that many investors don’t know about—until it’s too late.

What Lenders Don’t Tell You About No-Income Verification Loans with EDSCR

1. You Might Still Need Cash Reserves

What Lenders Say: “No income verification required.”

What They Don’t Say: “But you’ll need to show you have reserves.”

Even though EDSCR loans don’t require proof of personal income, lenders often require 6 to 12 months of reserves to prove you can cover payments if something goes wrong.

Solution:

✔ Have 6-12 months of mortgage payments in cash or liquid assets before applying.

✔ Consider using a business line of credit or other financing to strengthen your reserves.

2. Your Credit Score Still Matters

What Lenders Say: “No tax returns or employment verification needed.”

What They Don’t Say: “But you need a strong credit score.”

EDSCR loans aren’t hard money loans, meaning lenders still check your creditworthiness. A credit score below 680 can lead to higher interest rates or outright denial.

Solution:

✔ Aim for a credit score of 700+ for the best loan terms.

✔ Pay down outstanding debts and avoid hard credit inquiries before applying.

3. Down Payments Are Higher Than Traditional Loans

What Lenders Say: “Easier approval process.”

What They Don’t Say: “You’ll need a bigger down payment.”

Unlike conventional mortgages that allow 10-20% down, most EDSCR loans require 25-30% down—especially for new construction or short-term rental properties.

Solution:

✔ Be prepared to invest more upfront or explore seller financing to reduce out-of-pocket costs.

✔ Consider a BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy to recycle capital.

4. Some Lenders Restrict Short-Term Rentals (Airbnb, VRBO)

What Lenders Say: “We finance investment properties.”

What They Don’t Say: “But not all investment properties qualify.”

Many lenders hesitate to finance short-term rentals (STRs) because they consider them riskier than long-term rentals. If your loan is based on Airbnb income, expect stricter requirements.

Solution:

✔ Look for lenders who specialize in short-term rental financing.

✔ Have backup long-term rental projections to prove cash flow stability.

5. Interest Rates Are Higher Than Conventional Loans

What Lenders Say: “No tax returns needed!”

What They Don’t Say: “But you’ll pay a premium for flexibility.”

Because no-income verification loans carry more risk for lenders, interest rates are usually 1-2% higher than traditional mortgages.

Solution:

✔ Compare lenders to find the best rates—rates vary significantly.

✔ Consider refinancing later once your property is stabilized.

6. Loan Terms Are Shorter Than Traditional Mortgages

What Lenders Say: “Flexible financing for investors.”

What They Don’t Say: “You may have to refinance sooner than expected.”

Many EDSCR loans are structured as short-term loans (5-10 years), unlike traditional 30-year mortgages. That means you’ll need an exit strategy.

Solution:

✔ Have a clear plan to refinance, sell, or pay off the loan before the term ends.

✔ Build equity quickly through value-add renovations or rental increases.

How to Get Approved for an EDSCR No-Income Verification Loan

If you’re planning to apply for an EDSCR-based loan, here’s how to increase your chances of approval and secure the best terms:

✅ Have at least 6-12 months of reserves—even if lenders don’t require income verification, they want proof of financial stability.

✅ Maintain a credit score of 700+—higher scores lead to better interest rates and approval odds.

✅ Choose high-cash-flow properties—the stronger the rental income, the easier it is to qualify.

✅ Prepare for a higher down payment—most lenders require at least 25-30% down.

✅ Work with lenders who understand your strategy—some lenders won’t finance short-term rentals or new construction projects.

Final Thoughts: Is an EDSCR No-Income Verification Loan Right for You?

If you’re an investor looking to scale your portfolio without traditional income verification, EDSCR-based loans can be a powerful tool—but only if you understand the fine print.

✔ Perfect for self-employed investors & landlords.

✔ Faster approvals with no W-2s or tax returns required.

✔ More flexible than traditional bank loans.

🚀 But… you need strong reserves, a solid credit score, and a clear strategy to maximize your success.

Ready to take advantage of EDSCR financing? Now that you know what lenders won’t tell you, you can approach the process with confidence and avoid costly surprises! 🏡💰